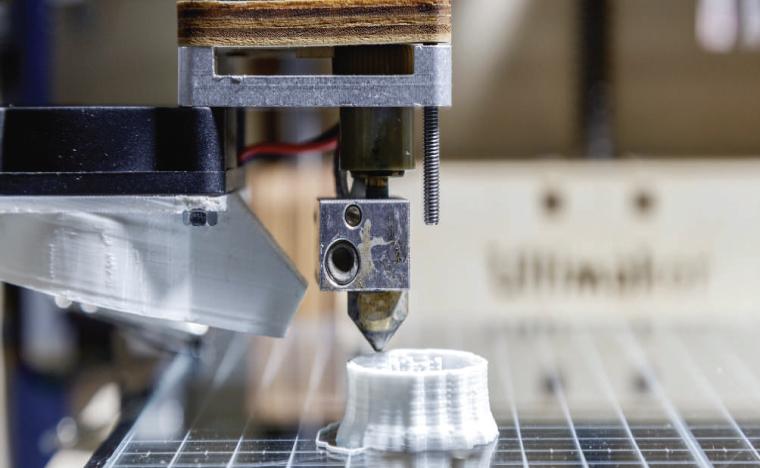

At the funds industry’s Alfi Autumn Conference in Luxembourg, a firm set up a 3D printer on its exhibition stand. As well as creating replicas of world-famous landmarks, people could have a 3D scan taken of themselves such that they could be ‘printed’ off-site, and a miniature replica posted on completion. Judging by the list of names signed up for this, there will be a lot of 3D printed, miniature asset managers in Christmas stockings this year.

The conference also included a panel focused on the long-term savings gap across Europe and the continuing trend away from government-backed pensions to workplace and individual savings schemes. The UK is already well on its way via auto-enrolment and the recent liberalisation of the annuities market. The industry response to this switch of focus to individuals saving through defined contribution schemes has been to develop more fund solutions. These include multi-asset funds, multi-manager funds, blended or fund-of-fund solutions, which along with glide paths and asset allocation structures are designed to take people up to and through retirement. With dedicated wealth managers out of the reach of most, the average person (or the trustee acting on their behalf) will be looking to outsource their asset allocation decisions and manager selections, and simply invest in a solution designed to give them an appropriate outcome.